In the latest earnings report, Uber Technologies Inc. has showcased a compelling performance that surpassed earnings expectations, recording 83 cents per share compared to the anticipated 50 cents. Despite this positive news, the company’s revenue of $11.53 billion fell slightly short of the expected $11.62 billion, resulting in a notable 5% drop in share prices. This dichotomy between earnings and revenue has left analysts and investors pondering the sustainability of Uber’s growth trajectory, raising questions about its market position and overall strategy.

Uber’s earnings growth reflects a robust increase in ride-hailing and delivery services, with revenue climbing approximately 14% year on year from $10.13 billion in Q1 of 2024. The company reported a net income of around $1.78 billion for the first quarter of 2025, a marked contrast to the net loss of $654 million in the same period last year. While these numbers paint a picture of improving profitability, the missed revenue forecast casts a shadow on the company’s growth potential and invites scrutiny on how it plans to expand its revenue streams moving forward.

Challenges Interests with Regulatory Scrutiny

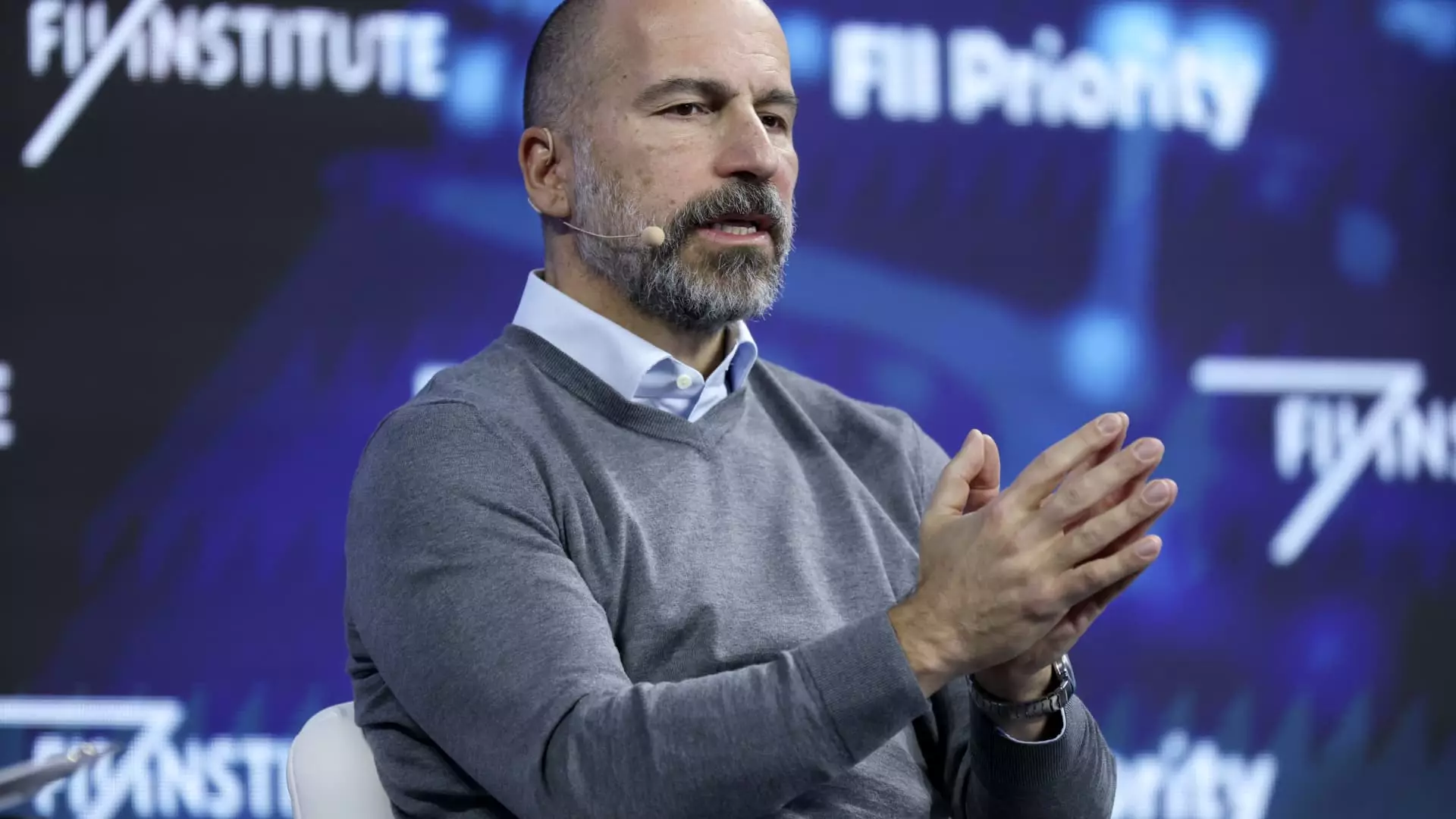

Adding to the mix, Uber faces increasing regulatory scrutiny as evidenced by the recent lawsuit from the Federal Trade Commission. Accusing the company of “deceptive billing and cancellation practices,” especially concerning its Uber One subscription service, the lawsuit raises serious questions about customer satisfaction and trust. CEO Dara Khosrowshahi expressed bewilderment regarding the suit during a conference call, describing the subscription as simple and effective in driving customer loyalty. However, the fact that 60% of Uber Eats’ gross bookings come from Uber One members might suggest a deeper issue: customers may feel confused about their subscriptions, which could dampen their willingness to engage with such services.

As Uber navigates this legal landscape, it is imperative that the company works to enhance transparency and customer education regarding its subscription offerings. Failing to address these concerns could not only alienate current users but also threaten to hinder future growth, particularly as competition intensifies in the ride-hailing and food delivery sectors.

Growth in Key Business Segments

Despite these challenges, Uber’s core business segments are on a strong upward trajectory. The company reported substantial year-over-year booking increases in both its Mobility and Delivery divisions, with gross bookings reaching $21.18 billion and $20.38 billion, respectively. This growth reflects the continued demand for ride-hailing services and food deliveries, as well as Uber’s ability to adapt to changing consumer habits.

Moreover, Uber’s monthly active users have climbed to an impressive 170 million, up 14% from the same time last year. Users completed roughly 3.04 billion trips during the quarter, showcasing the scalability of Uber’s platform amidst ever-increasing competition. This expansion underlines the importance of maintaining user engagement and continues to present a significant opportunity for revenue enhancement.

Strategic Moves Towards Autonomous Vehicles

Uber is undoubtedly positioning itself for the future with its foray into autonomous vehicle (AV) technology, which Khosrowshahi identifies as a game-changer for the company. By embracing AVs, Uber hopes not only to streamline operations but also to capture a larger share of the transportation market. The launch of robotaxi services in partnership with Waymo in Austin exceeds expectations, indicating that interest in autonomous rides is gaining traction among consumers.

However, the push into AV technology should not overshadow Uber’s current operational challenges. While the technology offers great promise, its implementation will require significant investment and strategic planning. Questions remain about the safety, regulation, and public acceptance of autonomous rides, which could either accelerate or hinder growth depending on how these issues are addressed.

Workplace Dynamics and Culture

Internally, Uber is shaking up its corporate culture. Recently, the company announced a change in its remote work policy, requiring employees to be in the office three days a week rather than two. This decision reflects Khosrowshahi’s belief that collaboration in the office is essential for peak performance. However, this move has sparked considerable debate and could impact employee morale, especially amid a landscape that increasingly favors remote work flexibility.

Further complicating matters, Uber has adjusted its sabbatical policy, extending the required tenure from five to eight years. Though management defends these changes as necessary for maintaining high performance, they risk fracturing the trust and commitment of employees at a time when job satisfaction and retention are paramount for success.

With these dynamic shifts in direction, Uber’s future remains a subject of intense scrutiny. The delicate balance between fostering growth and managing regulatory pressures, employee expectations, and technological advances will ultimately determine if Uber can maintain its momentum or falter in its quest for dominance in the ever-evolving landscape of mobility and delivery services.