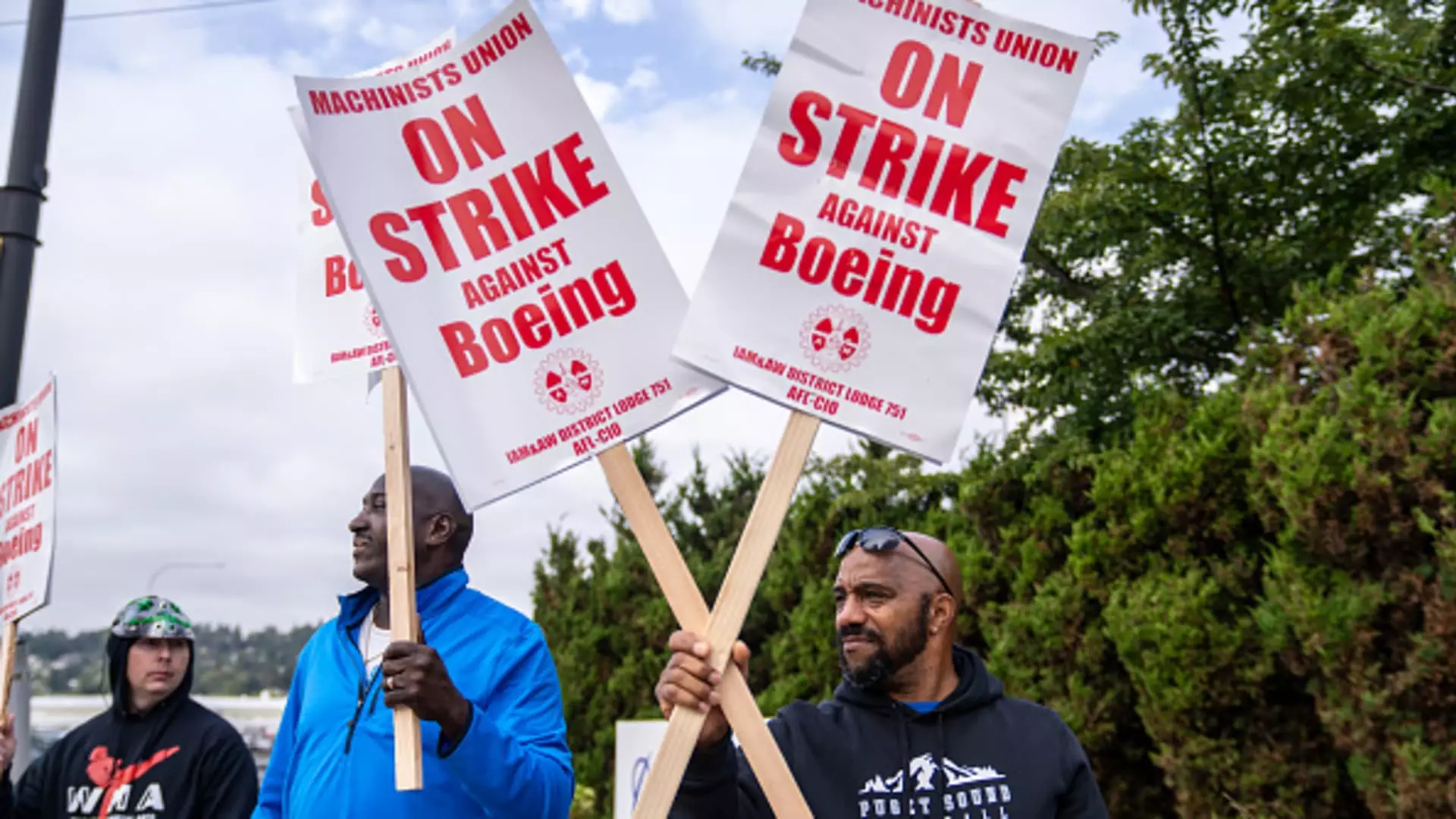

It’s been over a month since Boeing machinists, numbering more than 30,000, initiated a strike following a resounding rejection of a proposed contract. The ramifications of this labor action have only magnified the financial distress and organizational challenges that continue to plague the aerospace giant. Under the stewardship of new CEO Kelly Ortberg, who stepped into the role amid the company’s long-standing crisis, the strike adds layers of pressure, complicating what was already an arduous recovery process.

S&P Global Ratings has reported that the impact of the strike could steeply escalate, potentially costing Boeing upwards of $1 billion each month. This comes on the heels of multiple crises that have defined Boeing’s recent history. In the span of just one year, the firm grappled with significant operational issues, including a near-catastrophic incident involving the 737 Max, a model already tainted by the memories of two tragic crashes that led to an industry-wide reassessment of safety protocols. This labor unrest marks a continuation of turbulent times, exacerbating Boeing’s operational challenges.

The Stalemate and Its Consequences

So far, there has been little significant movement towards a resolution as the company remains locked in a stalemate with the union, the International Association of Machinists and Aerospace Workers (IAMAW). Factories in Seattle and other key locations have halted airplane production, creating a damaging cash flow deficit for the manufacturer. After the union overwhelmingly rejected a previously sweetened offer from Boeing, tension escalated further.

Harry Katz, an academic specializing in collective bargaining, has pointed out that Boeing will inevitably need to enhance its offer if it seeks to resolve the strike effectively. However, certain stipulations—including a return to a pension plan for workers—appear unlikely to materialize, leading Katz to predict that this labor conflict could stretch on for several more weeks.

Communication between Boeing and the union has reached a fractious point, culminating in the company filing a charge of unfair labor practices with the National Labor Relations Board. The allegations suggest that the union may have been negotiating in bad faith, introducing a level of venom into discussions that could hinder progress toward an agreement. Meanwhile, IAMAW President Jon Holden has called for a return to constructively engaging dialogue rather than resorting to intimidation tactics.

The ongoing strike has introduced significant financial stress for the workers involved, with many machinists experiencing a loss of income and health insurance benefits as the days of the strike extend. Yet, unlike the last major strike in 2008, workers find themselves in a relatively better position, thanks to a higher availability of contract jobs in the Seattle region—providing alternative means of income. The union has even facilitated job postings for gig economy roles, such as food delivery and warehousing, to support its members during this challenging period.

In a surprising move, Ortberg announced plans to shrink Boeing’s workforce by about 10%, indicating a series of layoffs that would also impact higher management levels. Compounding these troubling announcements were dismal preliminary financial results that highlighted significant losses—indicating that the company expects to report a loss nearing $10 per share for the third quarter alone.

While Ortberg may contend that these cost-cutting measures are necessary, industry analysts like Richard Aboulafia warn that the continuous layoffs and operational turmoil could undermine Boeing’s long-term stability. He argues that labor represents only a small fraction of aircraft production costs but its reduction will not enable the company to navigate its ongoing financial crisis effectively.

As Boeing’s challenges mount, investors brace for Ortberg’s first earnings call, scheduled for October 23. With stock prices dropping significantly—down 42% through late September—the pressure is on to demonstrate that Boeing is taking decisive steps to address its myriad issues. Analysts speculate that the latest financial results may signal that an equity raise could be on the horizon, as the firm begins to navigate the uncertainty brought about by halted productions and heightened costs.

Boeing’s future strategies need to recalibrate focus onto core operations, allowing for necessary innovations while streamlining its numerous projects. Yet, this will require an immediate resolution to the ongoing labor dispute if stability and improved performance are ever to be realized.

The current strike not only symbolizes a battle over labor rights but also illuminates the broader struggles within Boeing—a venerable institution that now finds its back against the wall. Moving forward, both the company and its workforce will need to engage in meaningful negotiations, recognizing that collaboration is essential for long-term recovery and success. The outcome of this situation will not only affect Boeing and its employees but will reverberate throughout the aerospace supply chain, further influencing the industry’s trajectory.