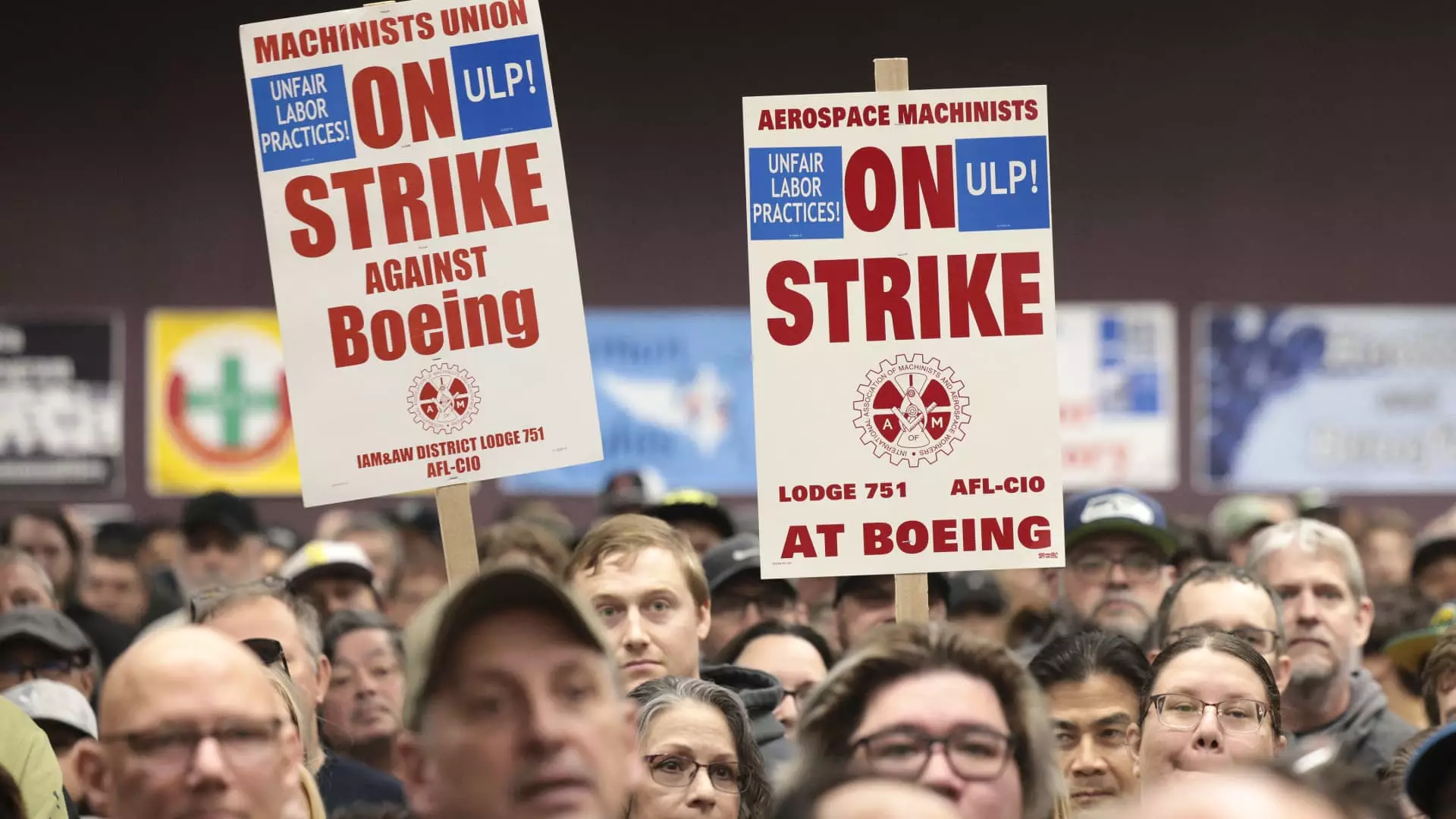

The Boeing Company stands at a crucial juncture as it navigates fallout from a major labor dispute. With machinists at the aerospace giant recently voting against a labor agreement that promised a significant 35% wage increase over four years, the implications of their decision extend far beyond the immediate ramifications of the strike. Fueled by a growing unrest among workers and exacerbated by years of operational challenges, the rejection, supported by 64% of union voters, spells trouble for an already beleaguered company battling a volatile production landscape.

The strike, which commenced on September 13, 2023, marks the first time Boeing machinists have halted work since 2008. This labor action comes amidst a backdrop of discontent surrounding a previous proposal that offered a 25% raise, rejected overwhelmingly by workers. The International Association of Machinists and Aerospace Workers union initially sought a 40% wage increase, reflecting the acute economic pressures faced by its members due to soaring living costs in the Puget Sound region. As the union advocates for better pay, it becomes evident that the stakes go beyond just compensation; they encompass job security and benefits, particularly in light of the contentious history surrounding Boeing’s pension plans.

Boeing’s financial positioning adds another layer of gravity to the situation. The company disclosed a staggering $6 billion loss during its latest quarterly report, marking its steepest downturn since 2020. With production ground to a halt, S&P Global Ratings estimates that Boeing is incurring costs of about $1 billion per month due to the strike. New CEO Kelly Ortberg has emphasized the urgency of resolving the strike to stabilize the company’s faltering operations and improve relations with its workforce. Yet, the pressure to generate profits while adhering to union demands poses an intricate challenge.

Ortberg’s administration highlights an intention to streamline operations and prioritize core business aspects, including a significant workforce reduction of 10%, which impacts its global employee base of 170,000. Such strategic decisions may further fuel dissatisfaction among a workforce feeling undervalued and unheard. The question remains whether Ortberg’s leadership approach can foster the necessary trust to bridge the gap between administration and labor.

Exploring the specifics of the most recent labor proposal reveals significant gains and persistent grievances. While the agreement proposed enhanced 401(k) contributions, a $7,000 bonus, and the commitment to keep future aircraft production at Pacific Northwest facilities, the absence of a pension plan continues to resonate as a sore point for many machinists. Union president Jon Holden acknowledged the value of the recent agreement but underscored that it fell short of fully meeting union demands. This highlights the critical need for Boeing to balance financial prudence with the necessity of addressing employee concerns in a constructive manner.

Moreover, the implications of the strike extend beyond Boeing’s immediate operational capabilities. The stoppage puts additional stress on a fragile aerospace supply chain still recovering from the complications of the COVID-19 pandemic. Suppliers like Spirit AeroSystems have already indicated potential layoffs or furloughs in response to the ongoing strike, showcasing how labor disputes can have cascading effects throughout interconnected industries.

As Boeing grapples with the realities of its labor dispute, the company must acknowledge that this is not merely a financial conundrum but a critical juncture in relationship-building with its workforce. The challenge lies in realigning its priorities to create an environment conducive to collaborative negotiations rather than adversarial ones. Future discussions will be pivotal not only for resolving current issues but also for restoring Boeing’s reputation as a leading employer in the aerospace sector.

The ongoing machinists’ strike presents a multifaceted challenge for Boeing, requiring a careful evaluation of labor relations, financial sustainability, and operational integrity. The path ahead demands nuanced engagement with employee concerns, an acknowledgment of the broader economic landscape, and a commitment to rebuilding trust within the organization. How Boeing responds in the coming weeks will undoubtedly shape its trajectory as it attempts to emerge from this turbulent chapter.